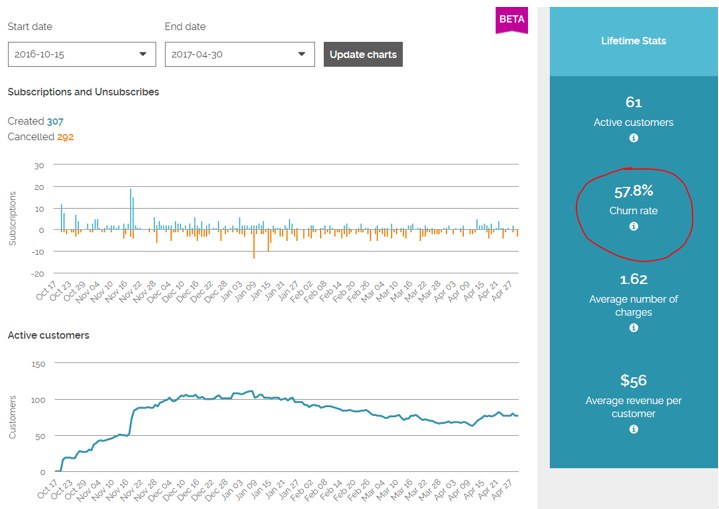

Although we knew that a product pivot was required, it wasn't until early April that we realized how truly in over our head we actually were.

Looking back, the offer formulation strategy made absolutely no sense. Take a #1 best selling Amazon product offer that has poor branding and marketing, analyze what deficiencies / issues / complaints existing customers have with the product, package it in a way to solve those concerns, add marketing and a story line and take it to a different channel to jump-start a brand and then expand. So what were we thinking? How were we so smart to think that we could walk into a completely unknown industry and take it by storm? WTF?!?!? It truly does take a special level of ignorance and/or hubris to spend almost 6 digits on a plan to ruin a #1 best-seller.

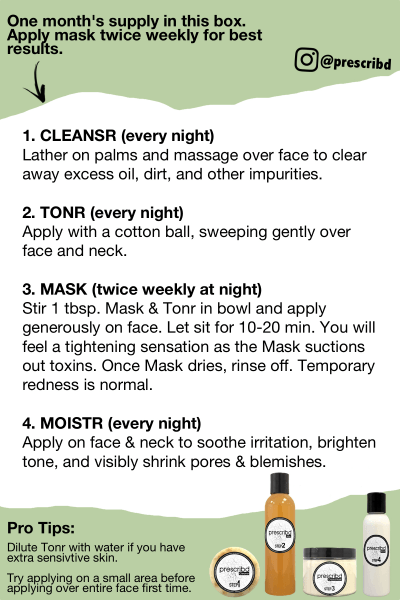

In doing our post mortem, it appears that others had figured out that there was a better way. Simply put a different label on the exact same thing and advertise it in the channel for about the same price and people will just buy your product because the packaging looks nice. <facepalm>